Mining in a Bear Market

We’re deep in a bear market. But this is not the first time we have seen a downturn in crypto markets.

In the year following December 2017 the value of Bitcoin dropped 84%. After a short period of recovery, with the onset of COVID19, Bitcoin lost over half of its value in two days in March 2020, falling from above $10,000 in February to below $4000 in March. Most recently in May 2021, the value of Bitcoin fell 53%. $1 trillion was wiped off the global crypto market in one week when Elon Musk refused to accept Bitcoin as payment for Tesla, China announced a more extensive crackdown on crypto mining, and the environmental impact of Bitcoin hit the headlines. The collapse of FTX and the knock-on effect on cryptocurrency trading platforms has added further instability to the market.

When we look at longer term developments in the Bitcoin mining market, there have been two important changes that impact the current downturn: 1) the institutionalization and consolidation of crypto mining by enterprise miners, 2) rapid advancements in mining hardware.

Bitcoin Resilience

Throughout price fluctuations, the fundamentals of Bitcoin (the architecture, the code, and the value proposition) never changed. The Bitcoin algorithm still uses a Proof of Work model and both mining and transactions flow through a distributed, decentralized ledger. There is a popular idea that the price of Bitcoin is cyclical. Regardless of market conditions, crypto regulation, or one-time events in the crypto space, as with any volatile asset, fluctuations are part of the long-term game.

Despite speculation that the price of Bitcoin might drop so low as to become unprofitable to mine, this seems unlikely. Not only has Bitcoin survived downturns before, but the game theory and economics of Bitcoin were designed so that Bitcoin could still be a viable asset even at lower prices. Bitcoin is still widely seen as the testcase for DeFi. As the first blockchain used for transferring and transacting value, Bitcoin is a high-stakes model for the future of finance.

Part of the reason Bitcoin is an important test case is that, as Mark Yusko said in July 2022, “every stock, every bond, every currency, every commodity, every piece of art, every collectable car, every house title, every marriage license, everything that can be titled or owned will eventually run on blockchains.” Ultimately “in the new blockchain era Bitcoin clearly is the base layer … it’s the most stable, most secure … it’s the most powerful computing network on the planet, bar none.”[1]

Agreeing with Yusko, many enterprise miners and Bitcoin investors have been sticking to their HODL strategy. Some enterprise mining companies need to sell their BTC to resolve treasury management issues, believing that the value of the BTC held is greater than the short-term gains made by selling. This strategy is only available to companies that are sufficiently well-established and consolidated to be able to keep mining BTC profitably at current price points while keeping their commitments to energy and operational costs. One of the key factors enabling established miners to keep going is the quality of their hardware.

Mining Hardware

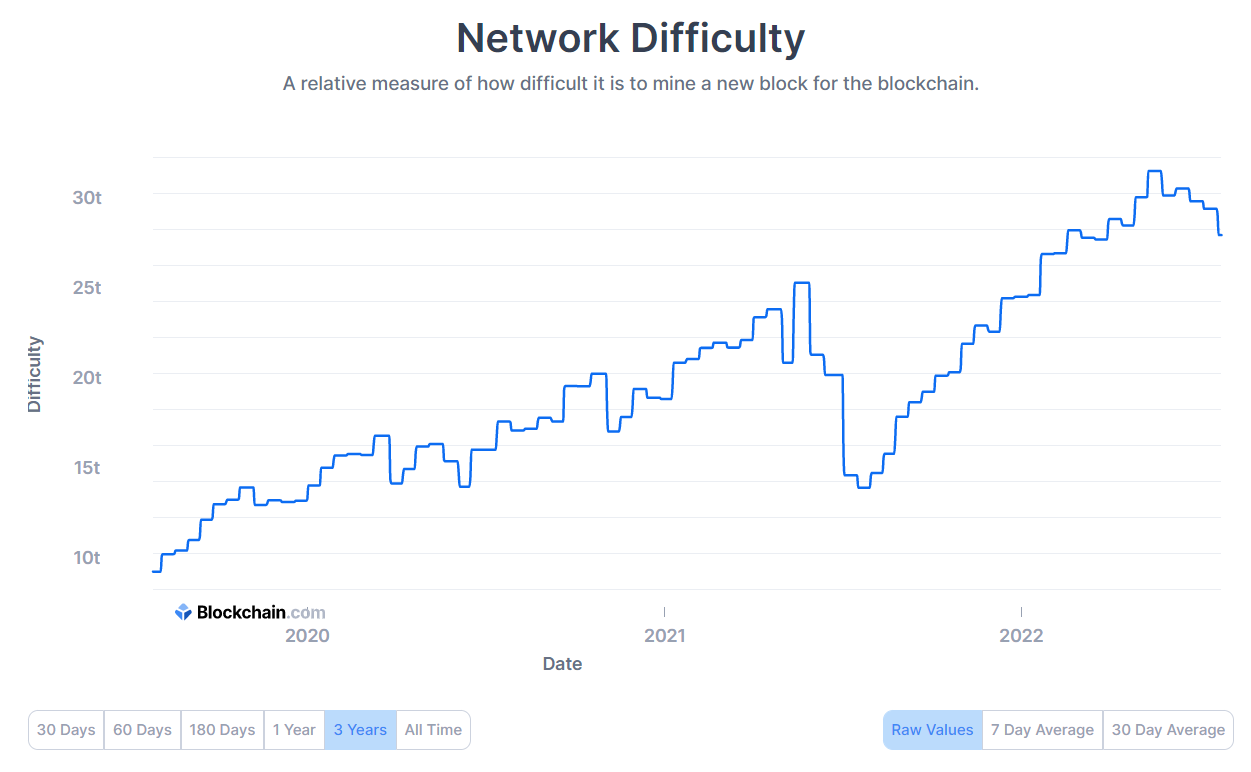

Mining difficulty is tied to the total hash rate of the bitcoin network. The difficulty is a measure of how much computing power it takes to mine a BTC block – at higher difficulty, it takes more computing power to mine the same number of blocks, making the network more resource intensive. The sort of hardware that is online impacts the network difficulty. Many enterprise miners have taken older machines offline as running them is not profitable – the price of BTC is lower than the cost of running and maintaining the machines because they are inefficient. If these machines stay offline and are not replaced by newer, more advanced machines, difficulty will decrease because there will be less competition for each block. Conversely, if older machines (most notably the Bitmain Antminer S9) are put back online, network difficulty will stabilize. In that instance, more established, larger-scale miners will be able to deploy more hash rate at the new, lower difficulty, and mine more BTC.

Source: Blockchain.com

Miners can survive, and even take advantage of this bear market by:

1) Maximizing the efficiency of hardware. Using low-power, high-performance hardware allows miners to capitalize on bitcoin mined regardless of network difficulty.

2) Optimizing mining operations. Some enterprise miners have been negatively impacted by operations issues including getting hardware online, cable management and cooling, and regulatory holdups. Minimizing operations disruption is key to surviving this bear market.

3) Optimizing energy costs. Enterprise miners have found different, creative ways of reducing energy bills while continuing mining (including partnering with energy suppliers, using otherwise-wasted energy sources, and lobbying governments for tax incentives).

As energy becomes more expensive, and relocating mining rigs is difficult and costly, powerful, efficient hardware is the key to surviving, and even thriving, in this latest bear market. With the right hardware, enterprise miners can come out of this cycle stronger and ready for the next bull market, whenever it begins.